With the constant addition of new countries to the European Union and other similar organizations it can be confusing to know the geography of the EU. While at a table quiz I failed to recall if there were 27 or 28 countries in the EU. I have therefore decided to do this blog post on the membership status of different countries to the European Union and a brief history on when different states joined.

Germany, the Netherlands, Luxembourg, Belgium, France and Italy were the founding members of the European Coal and Steel industry. This group was set up to strengthen the ties between European countries to prevent another war in Europe, after what a disaster World War II left the continent in. In 1957 (four years later,) the European Economic Community was established under the Treaty of Rome. The purpose of the Treaty of Rome was to create a common market for goods, services, capital and workers, it also wanted to put in place agricultural and transport policies for the six above-mentioned nations. In 1965 these two communities merged together along with the European Atomic Energy Community, the name European Economic Community was kept.

EEC expansion was next on the agenda. Denmark, the UK and Ireland joined the community in 1973. Then came the Single European Act, this improved European Council Management to allow for a Single Market and for the Introduction of Spain and Portugal to the community. Spain and Portugal joined the group in 1986. The Maastricht Treaty came into place in 1993. This formerly set up the European Union and started some of the earliest plans for a European Monetary Union. This is a little complicated so I have attached a link to a YouTube video to help explain. Courtesy of CPG Grey http://www.youtube.com/watch?v=O37yJBFRrfg

Now there are twenty-eight members of the European Union. After Portugal and Spain, Greece, Austria, Finland, Sweden, Cyprus, the Czech Republic, Hungary, Latvia, Lithuania, Malta, Poland, Slovakia, Slovenia, Romania, Bulgaria and finally in 2013 Croatia. The Maastricht Treaty's plans for a European Monetary Union have been successful. Eighteen countries have adopted the euro, you can see these countries on the map below in blue, courtesy of wikipedia.org/wiki/euro

The EU

Monday, 10 February 2014

Thursday, 6 February 2014

EU North-South Divide

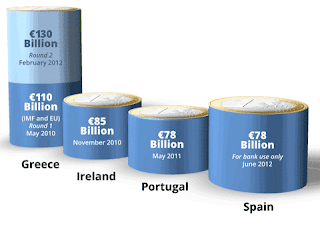

There is a term for the poorly preforming European States- "PIGS." It stands for Portugal, Ireland, Greece and Spain. I used to consider these countries as a group of unfortunate nations, whose governments were forced to ask for financial assistance from the EU. After Cyprus joined this group having taken a €17 billion bailout, and the large scale media attention towards Italy's financial state I noticed how, with the exception of Ireland who has since left the bailout system, all these countries are located in Southern Europe. I feared the EU could be moving towards an economic and social divide. Courtesy of realtruth.org

After further inspection, I realized that there was definitely an economic and social divide in Europe. Most Northern European countries have a much lower rate of interest on 10 year bonds; this means the international community views Northern European Countries as more financially stable. Lower interest rates allow Northern European countries to borrow large sums of money in times of budget deficits. The Southern nations do not have such low interest rates, and cannot cover budget deficits by selling large amounts of bonds in recessionary times. This forces them to ask for financial assistance from the EU. This is a graph of interest rates for the different EU countries. Courtesy of suomenpankki.fi

It is far from just economics that are at the cause of the North-South divide in Europe. Climate, agriculture and social confidence are also deepening the divide. Southern European countries have a climate named after the Mediterranean Sea, which they all border. The average summer temperature is 30 degrees Celsius while the average summer temperature of Germany is 22.6 degrees Celsius. The difference in temperatures between the North and South affect the agriculture of the regions. Expensive irrigation schemes have been put in place to farm large areas of the South, this along with overgrazing and sudden downpours leading to erosion, can make farming in this region expensive. Southern European countries tend to grow citrus fruit, tomatoes, olives and grapes. In Northern Europe more cattle are reared and grain grown. The economic output of farmingin the South is very low. Farming in Italy, for example, only makes up 2.5 per cent of gross domestic product. The hot climate of the South also means a much lower amount of land can be put under cultivation. In Italy only 5 per cent of the land is used for farming. Courtesy of foodsfromspain.com

People of the South tend to be more outgoing, sociable and use hand gestures a lot more than Northern Europeans. Experts believe this may be solely to do with the difference in weather between the two regions. The Southerners are much more open, this maybe simply because they spend more time socializing because of the warmer weather. Southern Europeans also have an excellent work break called the "siesta," they stop work for several hours due to the warm midday weather. Due to these social differences Southern Europeans are seen as more sociable and Northerners as more work conscious. This is why many Northern Europeans, especially Germans see the bailout programme as handing cart loads of cash to the greedy, lazy Southerners.

After further inspection, I realized that there was definitely an economic and social divide in Europe. Most Northern European countries have a much lower rate of interest on 10 year bonds; this means the international community views Northern European Countries as more financially stable. Lower interest rates allow Northern European countries to borrow large sums of money in times of budget deficits. The Southern nations do not have such low interest rates, and cannot cover budget deficits by selling large amounts of bonds in recessionary times. This forces them to ask for financial assistance from the EU. This is a graph of interest rates for the different EU countries. Courtesy of suomenpankki.fi

It is far from just economics that are at the cause of the North-South divide in Europe. Climate, agriculture and social confidence are also deepening the divide. Southern European countries have a climate named after the Mediterranean Sea, which they all border. The average summer temperature is 30 degrees Celsius while the average summer temperature of Germany is 22.6 degrees Celsius. The difference in temperatures between the North and South affect the agriculture of the regions. Expensive irrigation schemes have been put in place to farm large areas of the South, this along with overgrazing and sudden downpours leading to erosion, can make farming in this region expensive. Southern European countries tend to grow citrus fruit, tomatoes, olives and grapes. In Northern Europe more cattle are reared and grain grown. The economic output of farmingin the South is very low. Farming in Italy, for example, only makes up 2.5 per cent of gross domestic product. The hot climate of the South also means a much lower amount of land can be put under cultivation. In Italy only 5 per cent of the land is used for farming. Courtesy of foodsfromspain.com

People of the South tend to be more outgoing, sociable and use hand gestures a lot more than Northern Europeans. Experts believe this may be solely to do with the difference in weather between the two regions. The Southerners are much more open, this maybe simply because they spend more time socializing because of the warmer weather. Southern Europeans also have an excellent work break called the "siesta," they stop work for several hours due to the warm midday weather. Due to these social differences Southern Europeans are seen as more sociable and Northerners as more work conscious. This is why many Northern Europeans, especially Germans see the bailout programme as handing cart loads of cash to the greedy, lazy Southerners.

Sunday, 2 February 2014

Eurobonds and the European Debt Crisis

I was doing some research into the European Debt crisis and came across Eurobonds. I had not heard of it before and to understand its use you must understand the European Debt crisis as a whole, it is a creative solution to the sensitive EU bond market. The idea is that members of the euro would have a common rate of interest on bonds. The euro zone would sell Eurobonds and the capital raised would be disrupted to the country in need of extra money. The country that received the loan/bond would then pay back the bondholder the money lent, plus the common rate of Eurozone interest after a specific period of time.

This would be an excellent method of preventing euro countries from defaulting. Defaulting is not paying back the bondholders who lent you money. A euro member default is feared across the continent, it would cause interest rates on bonds from all euro members to surge. This would mean European governments would not have access to large amounts of cash. The euro countries would not have any means of covering their budget deficits and necessary, expensive public utilities would have to be shut down such as schools and hospitals.

Courtesy of the KPI library and timvlandas.com

Previously, when interest rates on a euro member's bonds went above 7 per cent a committee led by the European Central Bank, European Commission and the International Monetary Fund known as the Troika, took over the counties finances and bailed the country out, i.e. gave a large sum of money to the country in question so it can afford to pay back the money it raised from the bond market, and so that the country had enough money to pay for public expenses. When Greece, Ireland and Portugal were bailed out the money came from the European Financial Stability Facility and this organization got its capital from the other member states. The amount contributed by each member is shown in the table above.

Courtesy of ipinglobal.com

If Eurobonds get the go ahead Germany, France and many other states will not be forced to make any further expensive commitments to the European Stability Mechanism (which has since taken over from the temporary EFSF.) This way a euro member will not default as they will have access to much more cheap capital and will be able to, over a much longer period of time, ease their dependence on the bond market and move back to a budget surplus without the need for serious austerity. (The drastic cutting of public expenses and increase in taxes.) Austerity can damage a countries economy as it makes goods and services more expensive and increases unemployment rates.

If countries such as Germany, Luxembourg and Austria want financial stability while keeping the euro they will need to bite the bullet, and except slightly higher interest rates on euro bonds instead of their national bonds.

This would be an excellent method of preventing euro countries from defaulting. Defaulting is not paying back the bondholders who lent you money. A euro member default is feared across the continent, it would cause interest rates on bonds from all euro members to surge. This would mean European governments would not have access to large amounts of cash. The euro countries would not have any means of covering their budget deficits and necessary, expensive public utilities would have to be shut down such as schools and hospitals.

Courtesy of the KPI library and timvlandas.com

Previously, when interest rates on a euro member's bonds went above 7 per cent a committee led by the European Central Bank, European Commission and the International Monetary Fund known as the Troika, took over the counties finances and bailed the country out, i.e. gave a large sum of money to the country in question so it can afford to pay back the money it raised from the bond market, and so that the country had enough money to pay for public expenses. When Greece, Ireland and Portugal were bailed out the money came from the European Financial Stability Facility and this organization got its capital from the other member states. The amount contributed by each member is shown in the table above.

Courtesy of ipinglobal.com

If Eurobonds get the go ahead Germany, France and many other states will not be forced to make any further expensive commitments to the European Stability Mechanism (which has since taken over from the temporary EFSF.) This way a euro member will not default as they will have access to much more cheap capital and will be able to, over a much longer period of time, ease their dependence on the bond market and move back to a budget surplus without the need for serious austerity. (The drastic cutting of public expenses and increase in taxes.) Austerity can damage a countries economy as it makes goods and services more expensive and increases unemployment rates.

If countries such as Germany, Luxembourg and Austria want financial stability while keeping the euro they will need to bite the bullet, and except slightly higher interest rates on euro bonds instead of their national bonds.

Friday, 24 January 2014

The EU and Climate Change

On Wednesday the European Commission removed legislation focused on country specific renewable energy targets after 2020. It was done to give countries "flexibility" on the percentage of total energy consumption coming from renewable sources, such as wind and solar. But the European Commission has left the overall EU target of 27 per cent renewable energy by 2030. This move by the European Commission is, in my opinion, reckless and unrealistic.

Many European countries are finding it difficult to switch to renewable energy sources even if they are cost effective, because they lack the finance to invest in large amounts of new energy infrastructure, but the specific long term targets forces states to switch to renewable energy sources. This move now allows member states to relax about renewable energy targets. Some EU members are already becoming lazy with complying with the Renewable Energy Directive; this is forcing the European Commission to take cases in the Court of Justice against countries who fail to commit to their energy targets, including Austria, Poland and Cyprus. The removal of the specific long term targets means many countries will remove their aims to eventually become energy efficient, and the EU has a whole will have a slim chance of reaching its 27 per cent target by 2030. This means we will be living in an unhealthy, polluted, fossil fuel dependent world for many years to come.Courtesy of interestingenergyfacts.blogspot.ie

Many European countries are finding it difficult to switch to renewable energy sources even if they are cost effective, because they lack the finance to invest in large amounts of new energy infrastructure, but the specific long term targets forces states to switch to renewable energy sources. This move now allows member states to relax about renewable energy targets. Some EU members are already becoming lazy with complying with the Renewable Energy Directive; this is forcing the European Commission to take cases in the Court of Justice against countries who fail to commit to their energy targets, including Austria, Poland and Cyprus. The removal of the specific long term targets means many countries will remove their aims to eventually become energy efficient, and the EU has a whole will have a slim chance of reaching its 27 per cent target by 2030. This means we will be living in an unhealthy, polluted, fossil fuel dependent world for many years to come.Courtesy of interestingenergyfacts.blogspot.ie

Sunday, 19 January 2014

European Union Expansion

In February of last year the EU set a three-month deadline for the Ukraine to strengthen its government democratically, to allow for the signing of an association agreement with the EU in November. This was to be the start of closer ties and relations between the Ukraine and the EU. The Ukrainian government failed to make the improvements to its electoral system and did not release the prominent opposition politicians Yuriy Lutsenko and Yulia Tymoshenko from prison, the Ukrainian government then put off the signing of the association agreement in November, which led to mass protests in Western Ukraine.

Courtesy of thischildrenhere.org

Courtesy of thischildrenhere.orgRussia then saw its chance to regain political influence over the Ukraine, and has announced its intention to buy 15 billion dollars worth of Ukrainian bonds and to sharply cut the price of natural gas to the Ukraine. This week the Ukrainian government has put in place two pieces of anti-democratic legislation, which outlaws the dying protests in Western Ukraine. In desperation the EU has offered 88 million euro in budget support funds this month, and at least the Ukraine failed to join the Russian Customs Union.

This turn of events was probably good news for people living in the EU, because it allows the organization to focus on economic problems at home, and to improve the lives of people already in the EU, instead of trying to take on board other European countries who are clearly not ready at this time to join the Union. EU officials will most likely take a fresh look at the Ukraine in 2015, after the general elections, and after the EU has thoroughly handled domestic economic problems such as Greece and Spain.

Friday, 17 January 2014

Ireland: Leaving the Bailout

Ireland left the bailout in December 2013. It was the first EU country to leave the bailout programme and what should have been an historical day really didn't amount to much. Few Irish people even knew what conditions Ireland was allowed to leave the bailout under, and this is what gave me inspiration to start this blog. It turns out Ireland is not becoming financially independent and stable. Ireland could only leave the bailout because the National Assets Management Agency had €20 billion in cash reserves and because the ECB reduced Irish interest rates. The German Development Bank KFW now has to give direct loans to small and medium sized Irish businesses, as the Irish banks are still unable to offer loans at realistic interest rates. The troika are still going to make twice yearly inspections of the Irish economy. This all means that the Irish banking crisis is far from over and it is unlikely that Ireland will reduce its dependency on the Troika in the near future.

Monday, 13 January 2014

Welcome to my Blog

Hello, my name is Andrew. I will be posting blogs on EU regulations and how they affect individual countries and their people.

Subscribe to:

Comments (Atom)