I was doing some research into the European Debt crisis and came across Eurobonds. I had not heard of it before and to understand its use you must understand the European Debt crisis as a whole, it is a creative solution to the sensitive EU bond market. The idea is that members of the euro would have a common rate of interest on bonds. The euro zone would sell Eurobonds and the capital raised would be disrupted to the country in need of extra money. The country that received the loan/bond would then pay back the bondholder the money lent, plus the common rate of Eurozone interest after a specific period of time.

This would be an excellent method of preventing euro countries from defaulting. Defaulting is not paying back the bondholders who lent you money. A euro member default is feared across the continent, it would cause interest rates on bonds from all euro members to surge. This would mean European governments would not have access to large amounts of cash. The euro countries would not have any means of covering their budget deficits and necessary, expensive public utilities would have to be shut down such as schools and hospitals.

Courtesy of the KPI library and timvlandas.com

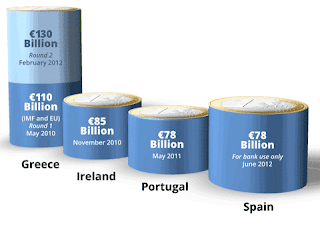

Previously, when interest rates on a euro member's bonds went above 7 per cent a committee led by the European Central Bank, European Commission and the International Monetary Fund known as the Troika, took over the counties finances and bailed the country out, i.e. gave a large sum of money to the country in question so it can afford to pay back the money it raised from the bond market, and so that the country had enough money to pay for public expenses. When Greece, Ireland and Portugal were bailed out the money came from the European Financial Stability Facility and this organization got its capital from the other member states. The amount contributed by each member is shown in the table above.

Courtesy of ipinglobal.com

If Eurobonds get the go ahead Germany, France and many other states will not be forced to make any further expensive commitments to the European Stability Mechanism (which has since taken over from the temporary EFSF.) This way a euro member will not default as they will have access to much more cheap capital and will be able to, over a much longer period of time, ease their dependence on the bond market and move back to a budget surplus without the need for serious austerity. (The drastic cutting of public expenses and increase in taxes.) Austerity can damage a countries economy as it makes goods and services more expensive and increases unemployment rates.

If countries such as Germany, Luxembourg and Austria want financial stability while keeping the euro they will need to bite the bullet, and except slightly higher interest rates on euro bonds instead of their national bonds.

No comments:

Post a Comment